Resources to help you

- Health care can cost less, depending on where you go. Save money and time by choosing the best in-network option for your situation. Learn more here.

- Example FSA Worksheet and list of eligible dependent care and health care expenses. You can also download a blank FSA worksheet here.

- Find out who gets an ID card and when.

Medical from UnitedHealthcare

Visit myuhc.com or call 1-844-587-8503. Download the UnitedHealthcare app for Apple / Android.

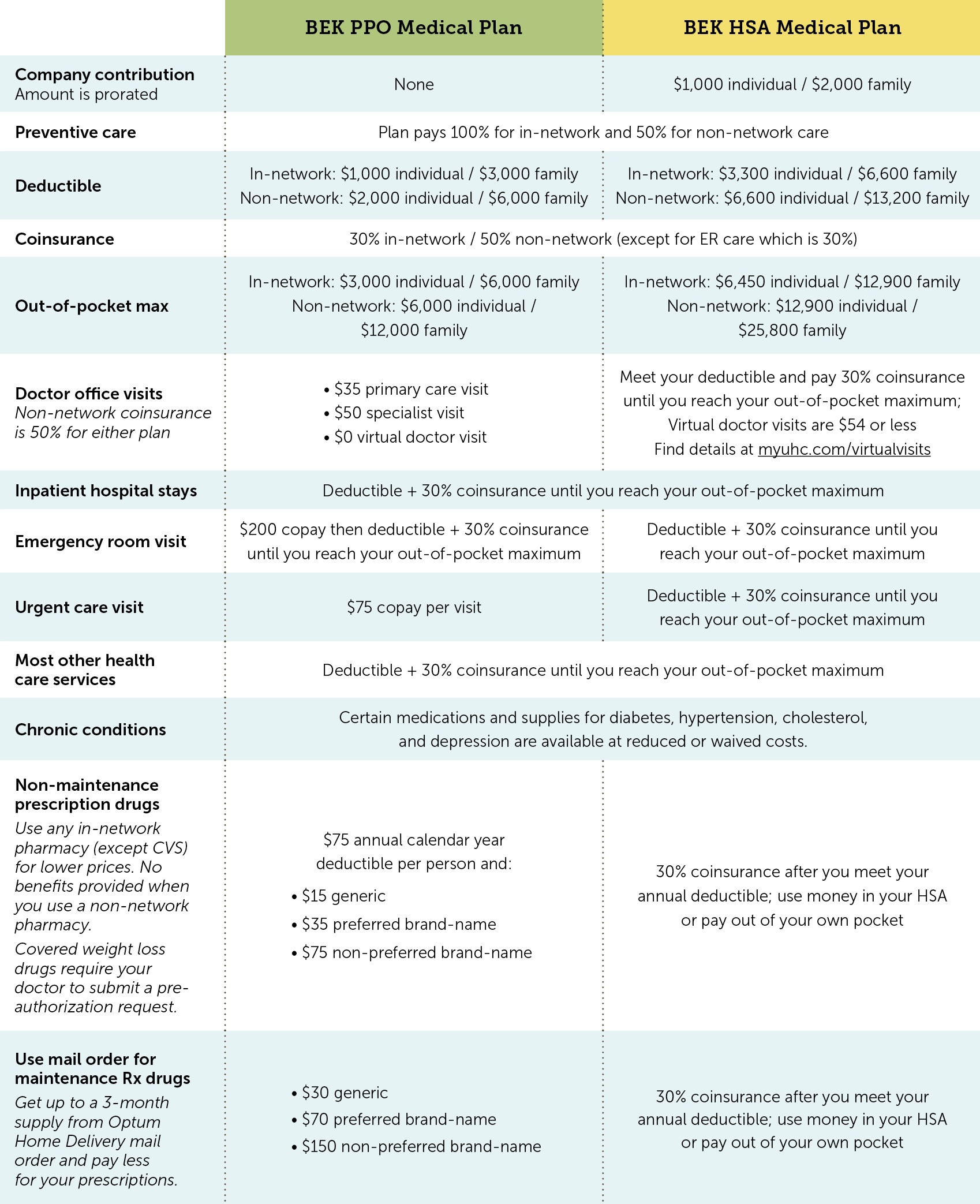

Ben E. Keith provides two types of medical plans:

- PPO – you’ll pay a copay when you see a provider or fill a prescription.

- HSA – this high-deductible health plan comes with a $1,000 tax-free Company contribution into a Health Savings Account (HSA) when you enroll. If you cover your family, you’ll receive a $2,000 Company contribution. The amount you receive will be prorated, based on the number of months you are enrolled in the HSA. You can also contribute your own tax-free money into your HSA, up to the IRS limit, to pay for eligible expenses like deductibles, dental or vision care. Use HSA dollars to pay for eligible medical expenses. Go to Physical Health > BEK health plans to learn more.

Both medical plan options provide you and your dependents with:

You’ll pay less if you use in-network providers. Find a list on myuhc.com.

Learn which type of doctor visit is right for you here.

Save big when you use Optum Home Deliver for maintenance Rx

With Optum Home Delivery, you can get up to a 3-month supply of your maintenance medications mailed right to your door.

You may pay less than what you do at in-store pharmacies, and standard shipping is free. That’s the magic of mail order.

Ready for home delivery? Here are the ways you can sign up:

- Go to myuhc.com or the UnitedHealthcare® app.

- Or, ask your doctor to send an electronic prescription to Optum Rx.

- Or, call the number on your medical ID card.

You will pay more for coverage if either of these surcharges apply to your personal situation:

- Spousal surcharge

If your spouse is currently working and eligible for medical coverage through his or her employer but you want to cover them on your BEK medical plan, you will pay $100 a month more in addition to the medical costs per pay period. - Tobacco surcharge

You’ll pay $100 more per month if YOU (the employee) enroll in a BEK medical plan and use tobacco in any form – cigarettes, e-cigarettes, cigars, pipes, snuff or chewing tobacco. If you use tobacco now but want to quit, call QuitLogix at 1-855-372-0040.

BEK Health Care FSA from Optum

Visit myuhc.com or call 1-866-755-2648. Download the Optum Bank mobile app for Apple / Android.

Visit myuhc.com or call 1-866-755-2648. Download the Optum Bank mobile app for Apple / Android.

- If you enroll in the BEK PPO Medical Plan , use your health care FSA debit card to pay for eligible medical, dental and vision expenses including deductibles, coinsurance, copays, prescriptions and over-the-counter medications.

- If you enroll in the BEK HSA Medical Plan, use money in your health care FSA to pay for eligible dental and vision expenses only. You must submit your expenses for reimbursement. You will not receive a debit card.

- Contribute up to $3,200 using pre-tax dollars in 2025.

- Your entire annual contribution amount is available to use on your coverage start date.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and this list of eligible expenses. Download a blank worksheet here. You can carry up to $640 in unused FSA dollars to use the following year.

- You cannot make changes to your Health Care FSA contribution amount during the year unless you have a Qualified Life Event, such as having a baby.

- If you leave Ben E. Keith, your participation in the Health Care FSA ends, and only expenses incurred prior to your termination date are eligible for reimbursement unless you elect COBRA coverage.

BEK Dependent Care FSA from Optum

from Optum

Visit myuhc.com or call 1-866-755-2648. Download the Optum Bank mobile app for Apple / Android.

- Use for daycare, nursery school, pre-school, after school, day camp for eligible children under age 13 or or senior daycare for aging parents.

- Contribute pre-tax dollars each calendar year of up to $5,000 per household or $2,500 if married, filing separately.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and this list of eligible expenses. Download a blank worksheet here.

- Funds are available as soon as they are deducted from your paycheck.

- Any unused FSA dollars at the end of the year can be reimbursed to pay for 2025 eligible expenses through March 15th, 2026.

- You cannot make changes to your Dependent Care FSA contribution amount during the year unless you have a Qualified Life Event, such as having a baby.

- If you leave Ben E. Keith, your participation in the Dependent Care FSA ends, and only expenses incurred prior to your termination date are eligible for reimbursement unless you elect COBRA coverage.

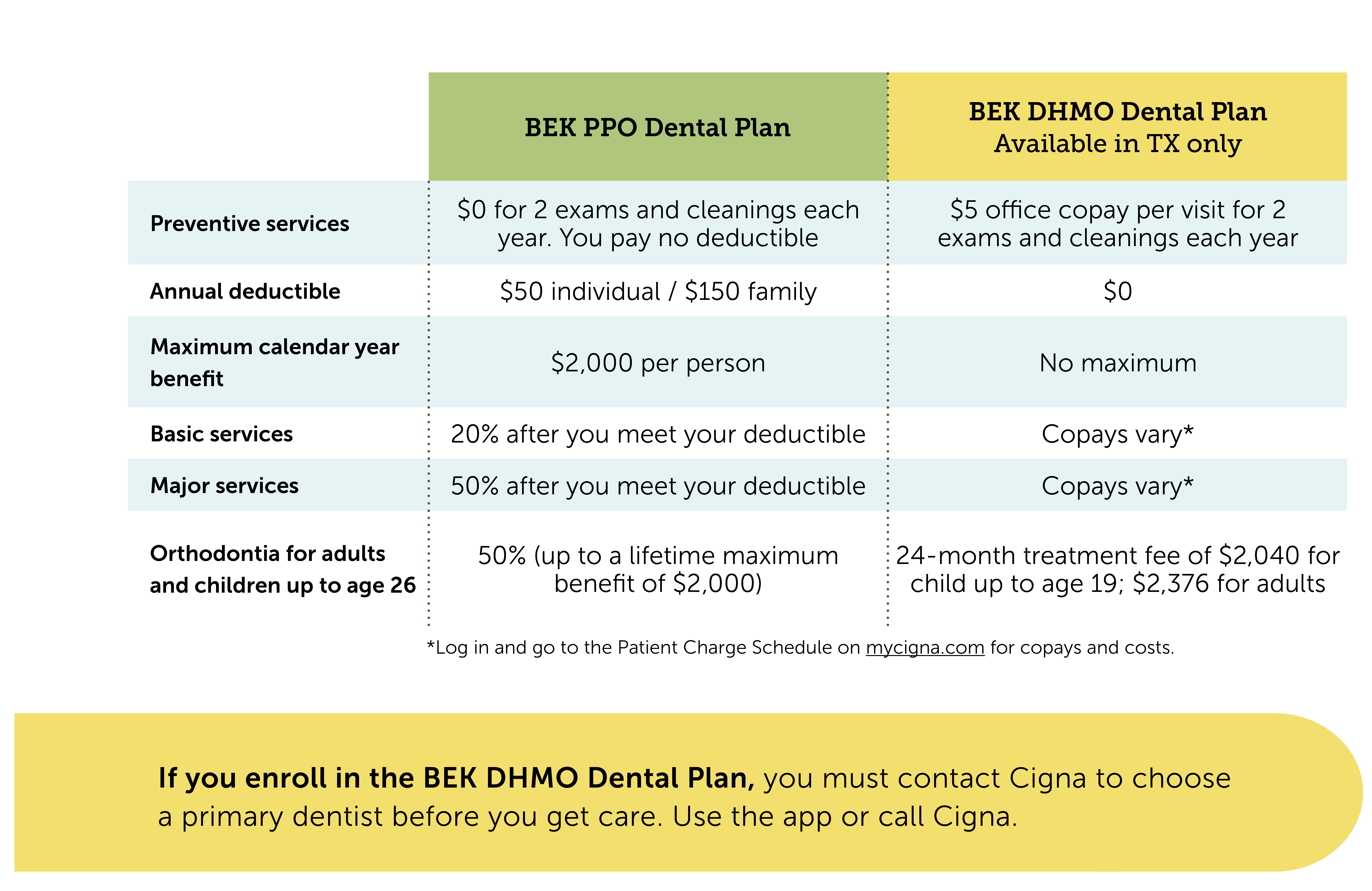

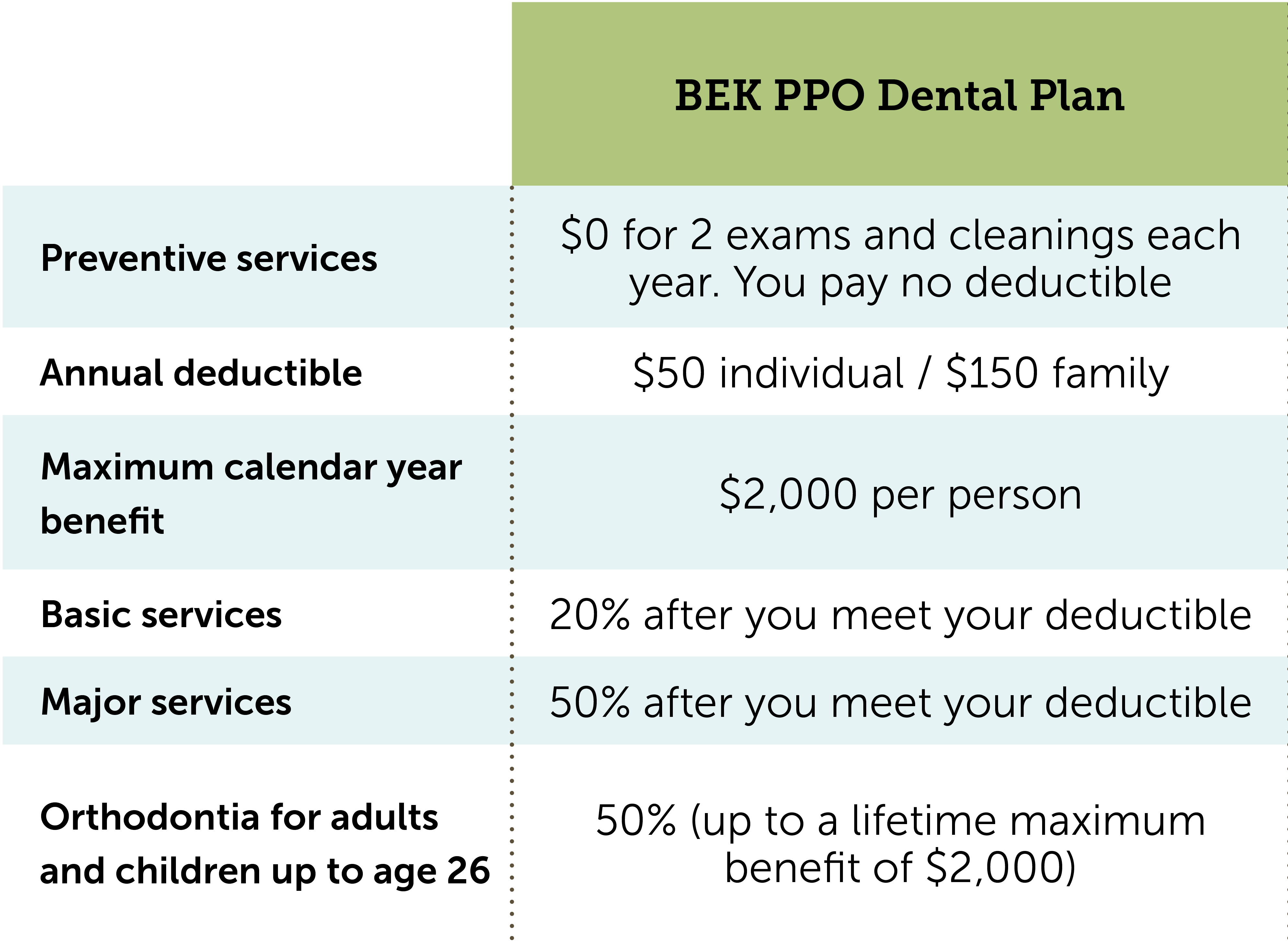

Dental from Cigna

![]() Visit mycigna.com or call 1-800-244-6224. Download the myCigna app for Apple / Android.

Visit mycigna.com or call 1-800-244-6224. Download the myCigna app for Apple / Android.

The BEK Dental Plan from Cigna offers routine dental care, X-rays, basic and major care. Log in to mycigna.com or use the myCigna app to find a dentist and pricing.

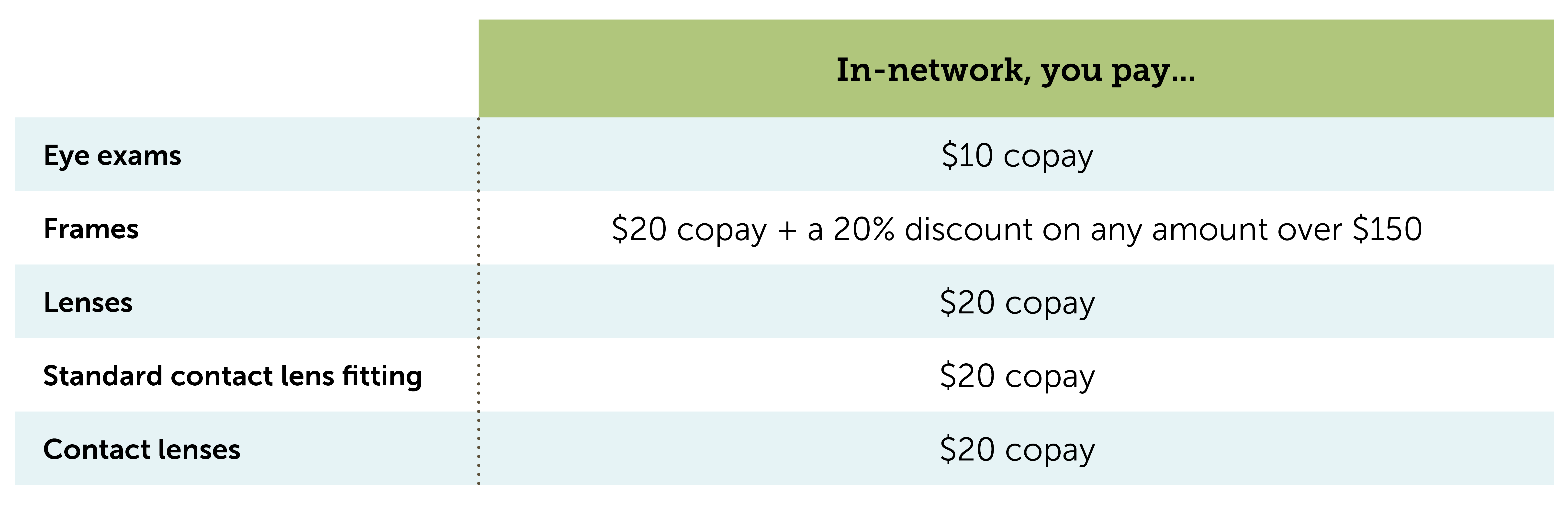

Vision from Superior Vision by MetLife

Visit metlife.com/vision or call 1-833-EYE-LIFE (1-833-393-5433). Download the MetLife app for Apple / Android.

Visit metlife.com/vision or call 1-833-EYE-LIFE (1-833-393-5433). Download the MetLife app for Apple / Android.

Regular eye exams keep you safe by screening for common vision problems and other conditions. Our vision plan covers frames, lenses, contacts and access to a discounts on LASIK. Over 50 top retailers are part of the network including Warby Parker, ContactsDirect, 1-800 Contacts and more. You also have access to a hearing exam and discounts on hearing aids.

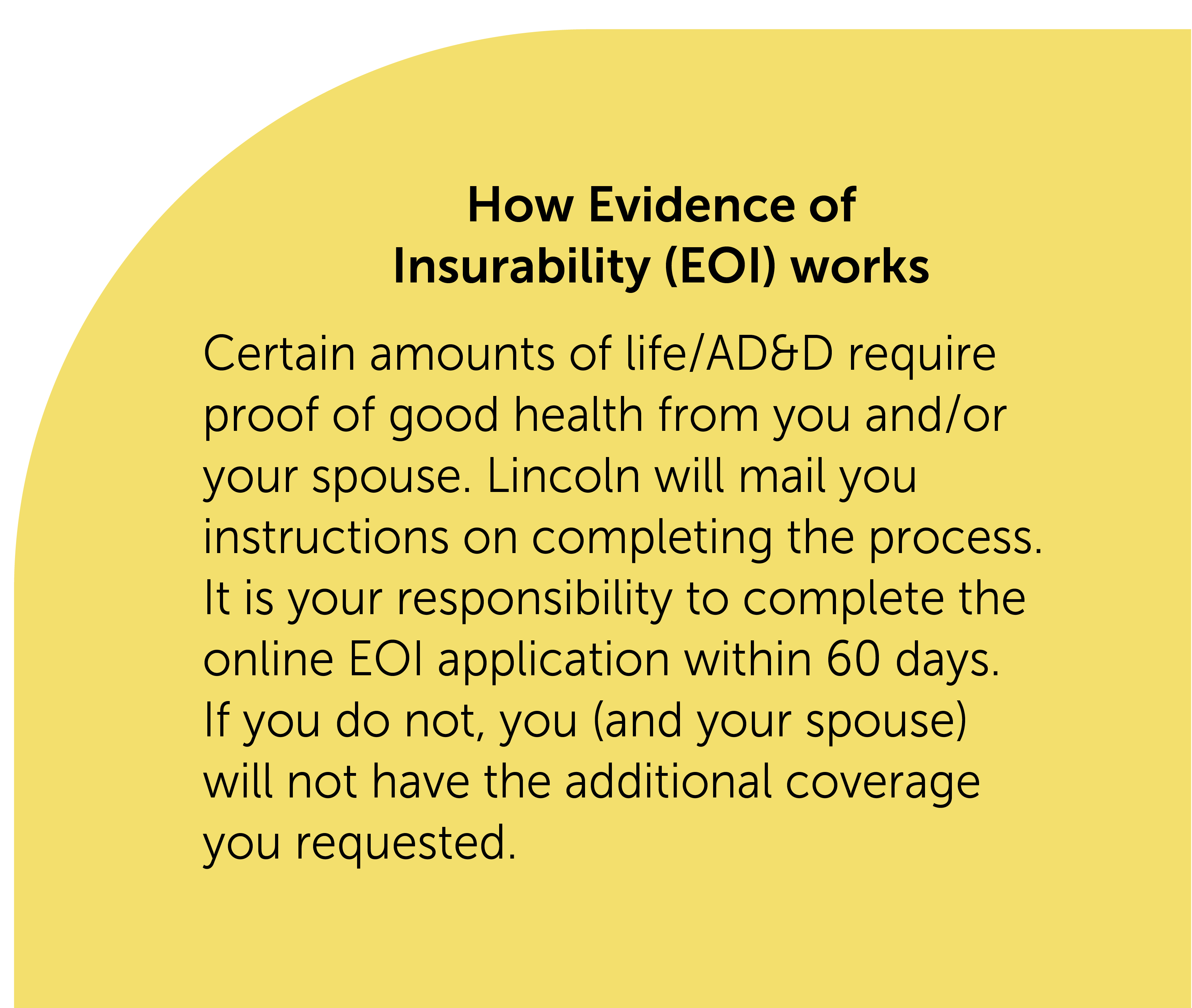

Life/AD&D from Lincoln Financial Group

Visit mylincolnportal.com and use Company code BEKCO or call 1-888-408-7300. Download the Lincoln Financial Mobile app for Apple / Android.

All full-time employees automatically receive $50,000 of Company-paid BEK Basic Life/AD&D. You don’t need to enroll and there is no cost to you. You do, however, need to name a beneficiary to make sure the person you want to receive your benefits, gets them.

Choose additional coverage for you and your family including:

- BEK Employee Supplemental Life/AD&D

Choose $50,000 to $950,000 in increments of $50,000. Rates are based on the age of the employee as of January 1st. During your initial enrollment, you are guaranteed coverage up to $300,000. After your initial enrollment, EOI (Evidence of Insurability) is required if you increase your coverage by more than $50,000 or increase to a coverage amount greater than $300,000. Find rates on Dayforce. - BEK Spouse Life/AD&D

Choose $50,000 to $250,000 in increments of $50,000. Spouse coverage is available in amounts up to 100% of your Employee Supplemental Life/AD&D coverage but cannot be more than $250,000. After your initial enrollment, EOI (Evidence of Insurability) is required if you increase your coverage to an amount greater than $50,000. Rates are based on the age of the employee as of January 1st. Find rates on Dayforce. - BEK Child Life/AD&D

Pay one amount no matter how many children you cover, up to age 26. Each enrolled child will have $10,000 in coverage except from birth to 14 days old, which provides $1,000 in coverage. You may enroll unmarried dependent children up to age 26 or older if incapable of self-care due to a mental or physical disability.

BEK Health Care FSA from Optum

Visit myuhc.com or call 1-866-755-2648. Download the Optum Bank mobile app for Apple / Android.

- If you enroll in the BEK BCBS Medical Plan, use your health care FSA debit card to pay for eligible medical, dental and vision expenses including deductibles, coinsurance, copays, prescriptions and over-the-counter medications.

- Contribute up to $3,200 using pre-tax dollars in 2025.

- Your entire annual contribution amount will be available to use on your coverage start date.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and this list of eligible expenses. Download a blank worksheet here. You can carry up to $640 in unused FSA dollars to use the following year.

- You cannot make changes to your Health Care FSA contribution amount during the year unless you have a Qualified Life Event, such as having a baby.

- If you leave Ben E. Keith, your participation in the Health Care FSA ends, and only expenses incurred prior to your termination date are eligible for reimbursement unless you elect COBRA coverage.

BEK Dependent Care FSA from Optum

from Optum

Visit myuhc.com or call 1-866-755-2648. Download the Optum Bank mobile app for Apple / Android.

- Use for daycare, nursery school, pre-school, after school, day camp for eligible children under age 13 or or senior daycare for aging parents.

- Contribute pre-tax dollars each calendar year of up to $5,000 per household or $2,500 if married, filing separately.

- Decide on an amount to contribute from each paycheck using this FSA Worksheet and this list of eligible expenses. Download a blank worksheet here.

- Funds are available as soon as they are deducted from your paycheck.

- Any unused FSA dollars at the end of the year can be reimbursed to pay for 2025 eligible expenses through March 15th, 2026.

- You cannot make changes to your Dependent Care FSA contribution amount during the year unless you have a Qualified Life Event, such as having a baby.

- If you leave Ben E. Keith, your participation in the Dependent Care FSA ends, and only expenses incurred prior to your termination date are eligible for reimbursement unless you elect COBRA coverage.

Dental from Cigna

![]() Visit mycigna.com or call 1-800-244-6224. Download the myCigna app for Apple / Android.

Visit mycigna.com or call 1-800-244-6224. Download the myCigna app for Apple / Android.

The BEK Dental Plan from Cigna offers routine dental care, X-rays, basic and major care. Log in to mycigna.com or use the myCigna app to find a dentist and pricing.

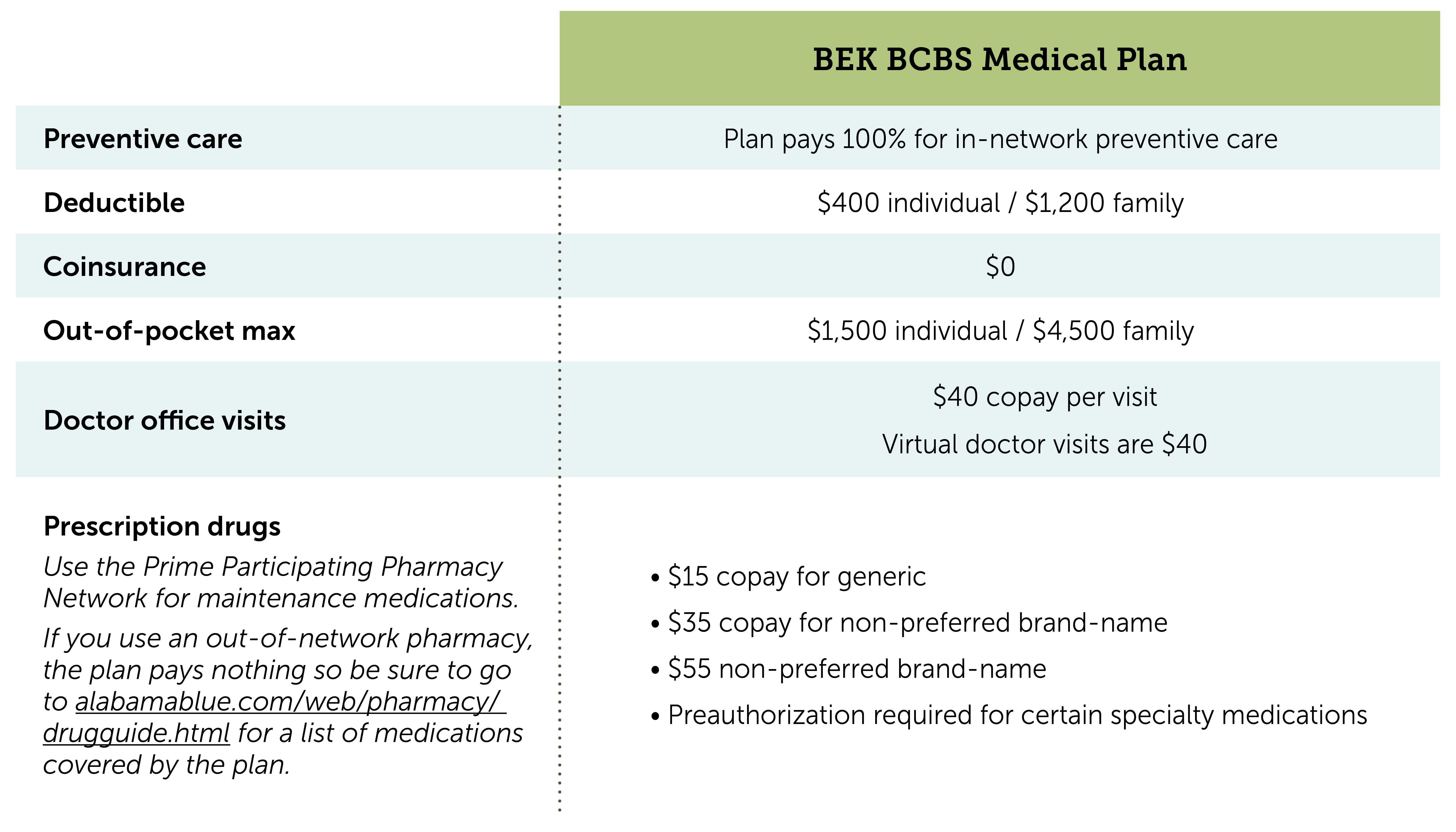

Medical from BlueCross BlueShield of Alabama

![]() Visit alabamablue.com or call 1-800-292-8868. Download the Alabama Blue mobile app for Apple / Android.

Visit alabamablue.com or call 1-800-292-8868. Download the Alabama Blue mobile app for Apple / Android.

Ben E. Keith offers comprehensive medical coverage from BlueCross BlueShield of Alabama. The BEK BCBS Medical Plan provides you and your dependents with:

FYI, you’ll pay more for non-network care. Find a list of providers and information about non-network benefits on alabamablue.com.

You will pay more for coverage if either of these surcharges apply to your personal situation:

- Spousal surcharge

If your spouse is currently working and eligible for medical coverage through his or her employer but you want to cover them on your BEK medical plan, you will pay $100 a month more in addition to the medical costs per pay period. - Tobacco surcharge

You’ll pay $100 more per month if YOU (the employee) enroll in a BEK medical plan and use tobacco in any form – cigarettes, e-cigarettes, cigars, pipes, snuff or chewing tobacco. If you use tobacco now but want to quit, call QuitLogix at 1-855-372-0040.